Featured

Irish Man’s “Voice Like Butter” Makes Classic Song Unforgettable

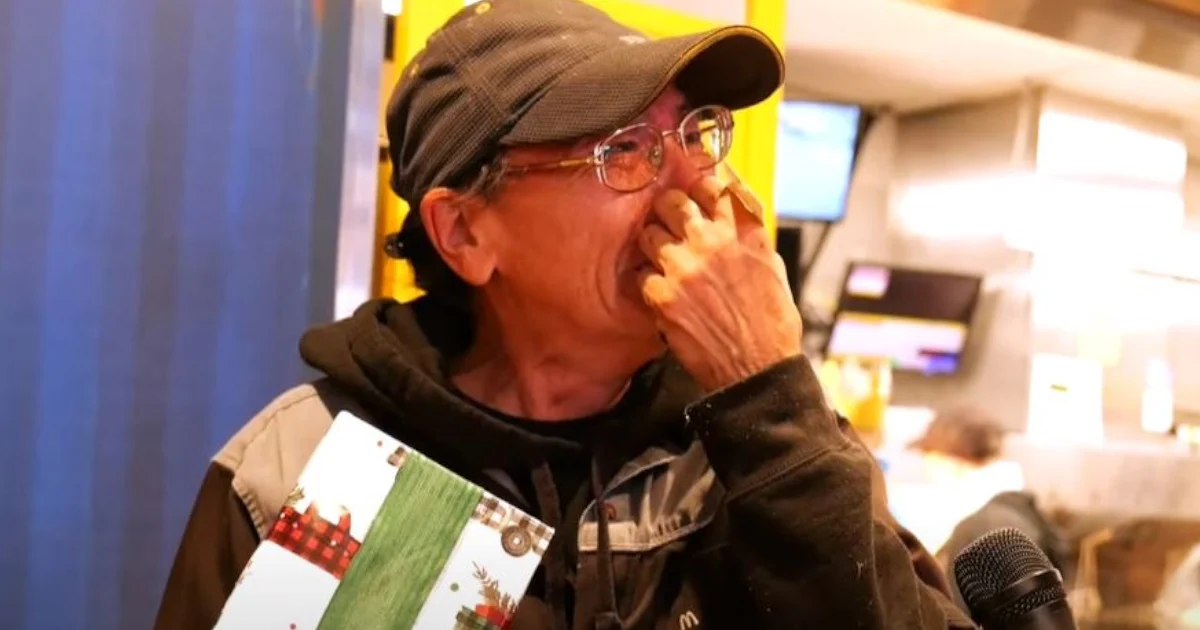

Ireland’s Got Talent was graced with an unforgettable performance when 31-year-old Steve Barry from Kerry took the stage. His rendition of “Somewhere” from West Side Story captivated both the audience and the judges. With his soaring vocals and emotional delivery, Steve transformed the classic song into a breathtaking moment. It was a performance that combined...

Jake Manning

06.17.25

Stay up to date on the latest stories on Shareably.

By signing up, I agree to the Terms and Privacy Policy

Thanks for signing up!

You're now subscribed to the latest stories.

Entertainment

Handsome Man’s Sultry Voice Earns Him “Golden Buzzer”

Jake Manning

06.16.25

Style

Wife Feels “Ugly” Until Makeover Makes Her Husband Fall In Love With Her Again

Jake Manning

01.21.25

Life

Little Boy Wakes Up From 16-Day Coma With Request Melting Internet’s Heart

Jake Manning

01.21.25

Entertainment

8 courageous dads in tutus perform comical dance that leaves crowd rolling

Jake Manning

11.30.24

Music

Man asks young boy to play Bohemian Rhapsody, so he puts on a show they’ll never forget

Jenny Brown

11.30.24

Beauty

Retired teacher goes short & all gray in makeover and looks fabulous

Jake Manning

11.30.24

More Top Stories

Life

Life

Mom leaves heartbreaking note on porch only to capture trick or treaters’ act of kindness

Jake Manning

11.04.24

Life

Kid with adorable Southern accent turns to granny and asks “I’m poor, ain’t I?”

Jake Manning

10.30.24

Life

Adorable twin babies can’t stop laughing and it’s melting hearts

Jake Manning

10.28.24

Life

Dad can’t find babysitter for court not expecting officer to take over in sweetest way

Jake Manning

10.22.24

Life

Toddler meets new baby brother and her reaction wins the internet

Jake Manning

10.22.24

Life

Big brother tries to teach little sis about manners only it takes funny turn

If you grew up with an older sibling, then you know all about the unsolicited advice they love to give. It’s almost like a rite of passage! They’ve been around longer, so naturally, they assume they’ve gathered enough wisdom to pass down to you. But whether you’re on the receiving or giving end of this...

Jake Manning

10.21.24

Great Dane can’t handle brother getting all the attention and throws funniest fit

Jake Manning

10.18.24

Recommended for you

Entertainment

Music

Michael Bublé performs soulful cover of Bee Gees song as touching tribute to Barry Gibb

Jake Manning

10.31.24

Music

Simon interrupts 11-yr-old singing Aretha Franklin but her comeback brings down the house

Jake Manning

10.31.24

Entertainment

Couple has crowd glued with silky dance then rock song takes it to a whole new level

Jake Manning

10.30.24

Music

Adorable kid sings Elvis tune forcing every judge to slam their button

Jake Manning

10.29.24

Entertainment

9 beautiful cowgirls line up and perform dance that rakes in 3M views

Jake Manning

10.29.24

Recommended for you

Trending

Trending

Hundreds show up for act of kindness after kids’ lemonade money is stolen

Jake Manning

10.29.24

Trending

Family takes in talkative parrot and her words quickly have them rolling

Jake Manning

10.25.24

Trending

Nervous rescue lion gets 1st taste of freedom and his reaction is heart-melting

Jake Manning

10.23.24

Trending

Farmers shake up the barn with ‘Farmer Rock Anthem’ leaving 2.7M smiling

Jake Manning

08.07.24

Trending

Man’s costume change so unexpectedly hilarious Simon says “That was genius!”

Jake Manning

08.07.24

Trending

Reporter can’t keep straight face as adorable baby elephant steals the show

Nearly 90% of African elephants have disappeared in the past century, primarily due to the extensive ivory trade, according to WWF. Currently, only about 415,000 wild elephants remain. These magnificent creatures face another significant threat: the deteriorating state of our environment. With this alarming backdrop, many people are striving to raise awareness about the need...

Jake Manning

08.02.24

Wild dolphin gets diver’s attention with gift he’ll never forget

Jake Manning

07.29.24

Recommended for you

Shopping

Shopping

Woman buys ‘cheap’ vase at thrift store and then learns it’s really a 2,000-year-old artifact

Elijah Chan

07.10.24

Shopping

Man shows groceries he bought for $100: “It’s getting to the point where people can’t live.”

Jenny Brown

12.12.23

Shopping

Man shows groceries he bought for $100: “It’s getting to the point where people can’t live.”

Jenny Brown

08.30.23

Shopping

Grocery chain combats loneliness with “slow lane” specifically for seniors who want to talk

Luis Gaskell

12.30.22

Shopping

Cashier watches woman on phone for 2 hours raising suspicion when she reaches for gift cards

Sasha Alonzo

07.26.22

Recommended for you

More from Shareably

Music

Music

Jennifer Nettles performs one of Neil Diamond’s greatest hits making him tear up with her version

Jake Manning

11.28.24

Entertainment

Entertainment

High school student perform enchanting waltz to Ed Sheeran’s “Perfect”

Jake Manning

11.27.24

Life

Life

Woman wakes to find an unknown dog on her patio furniture that refuses to leave

Jenny Brown

11.27.24

Life

Life

Police officer stops to have cute conversation with adorable baby owl

Jenny Brown

11.27.24

TV & Movies

TV & Movies

Hilarious Carol Burnett Show bloopers prove the entire cast were comedic geniuses

Jenny Brown

11.26.24

Music

Music

Cher gets emotional hearing Adam Lambert’s moving version of her famous song

Jake Manning

11.26.24